Guyana plans to install 33 MWp (megawatt peak) of grid-scale solar PV with battery storage in three of its un-interconnected (isolated) grids.

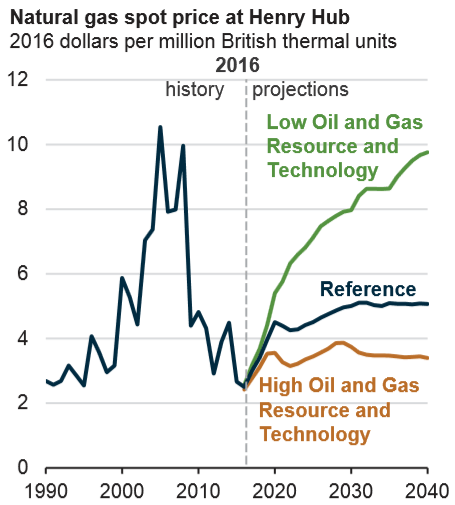

The Government of Guyana (GoG), notwithstanding the Country’s evolving oil and gas sector, is committed to the development of a cleaner, greener, and more diversified energy matrix that is based on indigenous resources as outlined in its recently published 2030 Low Carbon Development Strategy (LCDS). Aside from having the capacity to utilize hydropower, wind, and biomass, Guyana has significant solar PV potential.

Guyana has a long-term average global horizontal irradiance (GHI) of 5.0-5.9 kWh/m2 (kilowatt-hours per square meter) per day, based on satellite data. To put things in perspective, Germany, which has approximately 6.8% of the world’s installed solar PV capacity at the end of 2021, has very few locations with a GHI above 3.5 kWh/m2/day.

As such, the GoG has given the Guyana Power and Light Inc. (GPL) the mandate to utilize NORAD funding to execute a national solar photovoltaic (PV) project in alignment with its plans to increase renewable energy penetration and grid stability on the power system. The project will be administered through the Inter-American Development Bank (IDB) with GPL being the execution agency

The program is targeting eight projects totalling 33 MWp of solar PV in three of the country’s grids (Guyana has several un-interconnected grids) as follows:

- 15 MWp with a 15 MW, 1hr Battery Energy Storage System (BESS) in the Linden Isolated Power System (LIS),

- 8 MWp with an 8MW, 1hr BESS in the Essequibo Coast Isolated Power System (EIS), and

- 10 MWp in the Demerara-Berbice Interconnected System (DBIS)

The Linden project

The Linden project will involve three (3) PV farms, each rated at 5 MWp. The plants are proposed to be located at Block 37 (in the vicinity of Bamia on the Linden Soesdyke Highway), Retrieve on the eastern side of the Demerara River, and Dacoura on the western side of the Demerara River.

The Block 37 plant will be interconnected to the Amelia’s Ward 13.8 kV feeder, whilst the Dacoura plant will be interconnected to the Wismar 13.8 kV feeder. The Retrieve plant will, however, be interconnected directly to the 13.8 kV Retrieve substation.

In addition, given the high level of penetration, a total of 15 MW (megawatt), with a minimum duration of 1 hour, of battery energy storage system (BESS) will also be installed and interconnected to the Linden system for stability purposes.

The Linden project will initially satisfy approximately 38% of the demand with an average annual generation of 20.12 million kWh (kilowatt-hour). This will result in approximately 17,182 tons of CO2 (carbon dioxide) being avoided annually.

The Essequibo Coast project

The Essequibo Coast project will involve two (2) PV farms, rated at 4.4 and 3.6 MWp. The plants are to be located at Ondereeming and Lima Sands, respectively.

The Onderneeming plant will be interconnected to the South 13.8 kV feeder, while the Lima Sands plant will be interconnected to the North 13.8 kV feeder.

Much like the Linden project, given the high level of penetration, a total of 8 MW (megawatt), with a minimum duration of 1 hour, of BESS will be installed and interconnected to the Essequibo Cost system for stability purposes.

The Essequibo Coast project will initially satisfy approximately 28% of the demand with an average annual generation of 12.36 million kWh, which will result in approximately 9,390 tons of CO2 being avoided annually.

The Berbice Project

The Berbice project will involve three (3) PV farms. A 4 MWp plant at Trafalgar on the west coast of the Berbice; a 2 MWp plant at Prospect on the east coast of the Berbice; and a 4 MWp plant at Hampshire in Corentyne, Berbice.

The Trafalgar and Prospect farms will interconnect via an express 13.8 kV line to the 13.8 kV busbar at the Onverwagt and Canefield substations respectively. The Hampshire farm will interconnect to the Canfield F3 13.8 kV feeder.

These plants will be a part of the DBIS and will satisfy a very small portion of the demand of the DBIS. However, the distributed nature of the project will serve to support the distribution network and reduce losses by supplying power closer to the end user.

The plants will generate approximately 16.14 million kWh annually, which will result in the avoidance of 10,671 tons of CO2 annually.

The estimated energy production and land requirements for each plant are shown in Table 1 below.

| Site | Plant Size (MW) | System | Yearly PV Energy Production (MWh) | DC Capacity Factor | Land Requirement (acres) |

| Prospect, East Coast Berbice | 3.0 | DBIS | 4,842 | 18 | 15 |

| Hampshire, East Coast Berbice | 3.0 | DBIS | 4,842 | 18 | 15 |

| Trafalgar, West Coast Berbice | 4.0 | DBIS | 6,459 | 18 | 20 |

| Lima Sands, Essequibo Coast | 3.6 | EIS | 5,560 | 18 | 18 |

| Onderneeming, Essequibo Coast | 4.4 | EIS | 6,795 | 18 | 22 |

| Block 37, Linden | 5.0 | LIS | 6,707 | 15 | 15 |

| Retrieve, Linden | 5.0 | LIS | 6,707 | 15 | 15 |

| Decoura, Linden | 5.0 | LIS | 6,707 | 15 | 15 |

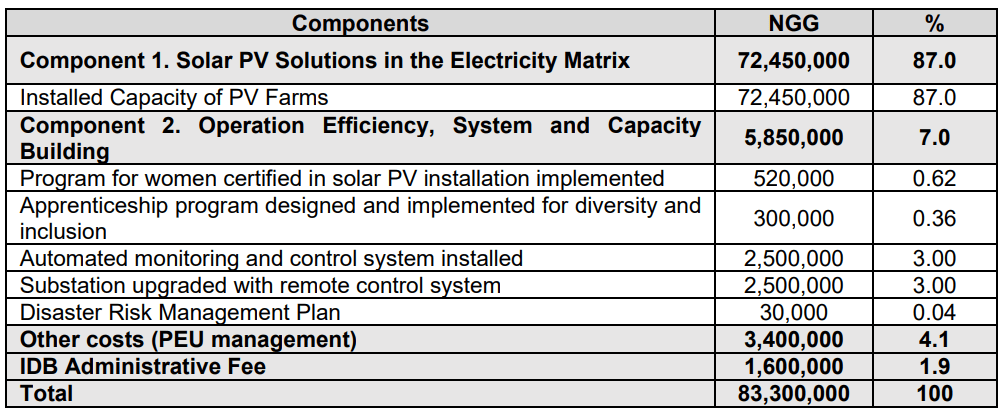

Project Funding

All eight projects form part of the Guyana Utility-scale Solar Photovoltaic Program (GUYSOL) and will be funded through the Norwegian Agency for Development Cooperation (NORAD) Fund. The non-reimbursable funding, which amounts to US$83.3 million is structured as shown in Table2:

The deadline for commencement of the works under the program is two years, counted from the effectiveness of the Non-reimbursable Financing Agreement, which was signed on 13th September 2022 and made effective as of the 15th June 2022.

On September 18, 2014, WBR subsidiary, Content Solar Ltd., signed a 20-year power purchase agreement (PPA) with the Jamaica Public Service Company (

On September 18, 2014, WBR subsidiary, Content Solar Ltd., signed a 20-year power purchase agreement (PPA) with the Jamaica Public Service Company (

![unknownSolar-farm[1]](https://xenogyre.com/wp-content/uploads/2015/06/unknownsolar-farm1.jpg?w=300)